Loading

Get Fp-129a 2015 Extension Of Time To File - Otr - The District Of Columbia - Otr Cfo Dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FP-129A 2015 Extension Of Time To File - Otr - The District Of Columbia - Otr Cfo Dc online

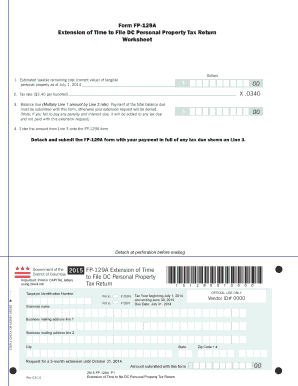

Filing Form FP-129A is a crucial step for obtaining an extension for the District of Columbia Personal Property Tax Return. This guide aims to provide clear, step-by-step instructions on how to accurately complete the form online, ensuring you meet all necessary requirements to successfully submit your extension request.

Follow the steps to complete the FP-129A form online effectively.

- Click the ‘Get Form’ button to access the FP-129A document and open it in your preferred form editor.

- Begin by filling in your taxpayer identification number in the designated field. This is required to process your extension request.

- Enter your business name in the next field below your identification number. If you are using a Federal Employer Identification Number (FEIN), make sure to fill in that field.

- Provide your business mailing address, including street address, city, state, and zip code. Ensure all information is accurate.

- In the section requesting the tax year, indicate the period beginning from July 1, 2014, and ending June 30, 2015.

- Complete the area for the estimated taxable remaining cost of tangible personal property. This is the current value of your assets as of July 1, 2014.

- In the next part, input the tax rate and calculate the balance due by multiplying your estimated taxable amount by the tax rate.

- Enter the balance due in the related section on the form. Remember, this payment must accompany your extension request.

- If applicable, calculate penalties and any interest accrued if there is outstanding tax due as of the due date.

- Sign and date the form at the designated area to validate your request for an extension.

- Lastly, save your changes, download the completed form, and print it out to attach with your payment. Ensure all documents are accurate before mailing them.

Complete and submit your FP-129A form online today to secure your extension!

Taxpayers can file their 2022 D-40 form and schedules as well as the standalone Schedule H tax return, at no cost, via the MyTax.DC.gov portal. Filing Deadline: The filing deadline to submit Tax Year 2022 individual income tax returns or an extension to file and pay tax owed is Tuesday, April 18, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.