Loading

Get 10 99 Employee Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 10 99 Employee Form online

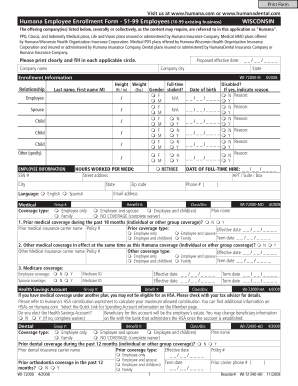

Completing the 10 99 Employee Form online is a crucial step in your employee enrollment process. This guide provides clear and supportive instructions to ensure you fill out the form accurately, making the process more efficient and understandable.

Follow the steps to fill out the 10 99 Employee Form online.

- Press the ‘Get Form’ button to access the 10 99 Employee Form online and open it in your editing interface.

- Enter the proposed effective date for coverage in the appropriate field.

- Provide your company name, city, and state in the specified sections.

- Fill in the enrollment information, including relationship and personal details such as height and weight.

- Specify the gender for each individual being enrolled, denoting either 'M' or 'F' as applicable.

- Indicate the hours worked per week and the street address, city, and state of the employee.

- Select your preferred language, either English or Spanish, from the options provided.

- Provide the date of birth and Social Security number for each enrolled individual.

- Complete the sections related to medical coverage, ensuring you answer all questions regarding prior coverage and Medicare.

- Fill in the benefit and group numbers, and confirm your coverage preferences for medical, dental, and vision.

- Review all provided information for accuracy before saving your changes.

- Once all fields have been completed, download, print, or share the filled-out form as needed.

Start completing your 10 99 Employee Form online today for a seamless enrollment experience.

You're Responsible for Paying Quarterly Income Taxes. ... You're Responsible for Self-Employment Tax. ... Estimate How Much You'll Need to Pay. ... Develop a Bulletproof Savings Plan. ... Consider Software & Tax Pros.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.