Loading

Get Vest Student Verification Form - Virginia529 College Savings Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VEST Student Verification Form - Virginia529 College Savings Plan online

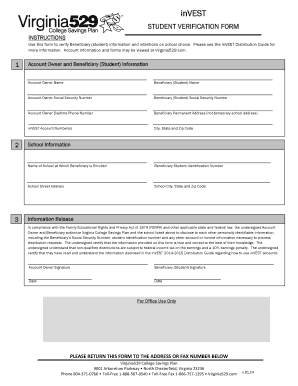

The VEST Student Verification Form is an essential document that verifies the student’s information and school choice for the Virginia529 College Savings Plan. This guide provides step-by-step instructions for completing the form online to ensure a smooth and efficient process.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the account owner’s information in the designated fields. This includes the account owner’s full name, Social Security Number, daytime phone number, and address (city, state, and zip code). Ensure this information is accurate as it is crucial for identification.

- Fill out the beneficiary's (student’s) information. This includes their full name, Social Security Number, and permanent address. The permanent address should not be the temporary school address.

- Input the inVEST account number(s) and ensure that each entry is accurate to prevent any processing issues.

- Complete the school information section by entering the name of the school the beneficiary is enrolled in, including their student identification number and the school’s street address, city, state, and zip code.

- Review the information release section. This confirms that both the account owner and the beneficiary authorize the necessary information to be shared in compliance with legal standards. Ensure both parties understand the implications before signing.

- Obtain the necessary signatures from both the account owner and the beneficiary. Date the signatures to confirm the completion of the form.

- After filling out the form, review all information for accuracy. Once verified, you can save changes, download, print, or share the completed form as needed.

Complete the VEST Student Verification Form online today to ensure your college savings plan is on track.

Since residents of Virginia can deduct contributions they make to the Virginia 529 plan (and cannot deduct contributions if participating in other state plans), VA 529 is the best option for residents. Despite being the best option, and being ranked as a top plan nationally, it still has plenty of flaws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.