Loading

Get Vest Distribution Request Form - Virginia529 College Savings Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VEST Distribution Request Form - Virginia529 College Savings Plan online

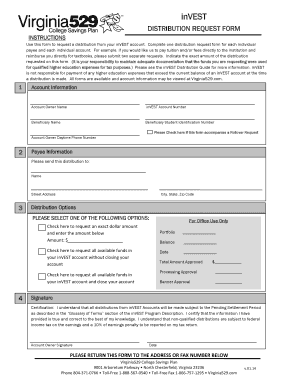

The VEST Distribution Request Form is an essential document for requesting a distribution from your inVEST account. Accurately completing this form is crucial to ensure that your request is processed efficiently and correctly.

Follow the steps to fill out the VEST Distribution Request Form online effectively.

- Click ‘Get Form’ button to access the VEST Distribution Request Form. Once obtained, open the form in your selected digital editor.

- In the first section, 'Account Information', provide details including the account owner name, your inVEST account number, the beneficiary name, and their student identification number. Ensure accurate entries to avoid processing delays.

- Indicate if this form accompanies a rollover request by checking the appropriate box. This step is essential if you intend to move funds between accounts.

- Next, fill out the 'Payee Information' section. You will need to provide the payee's name and street address, including city, state, and zip code. It’s vital to double-check these details for accuracy.

- Proceed to the 'Distribution Options' section. Choose one of the distribution options that suits your needs. If you are requesting a specific dollar amount, check the box and enter the amount below. Alternatively, select the option for requesting all available funds without closing your account or to close your account altogether.

- In the 'For Office Use Only' section, leave the fields blank as these will be filled out by the processing team.

- Read the certification statement carefully. By signing this section, you confirm that the information you provided is accurate and that you understand the implications of non-qualified distributions.

- Lastly, enter the date, sign the form, and ensure to return it to the designated address or fax number provided at the bottom of the form.

- Once you have completed the form, save your changes, and you may choose to download, print, or share the filled-out form as necessary.

Complete your VEST Distribution Request Form online today to ensure your higher education expenses are funded promptly.

529 plans offer unsurpassed income tax breaks. Although contributions are not deductible, earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.