Loading

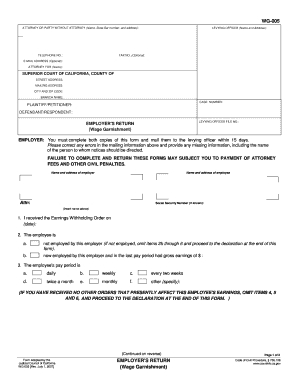

Get Wg-005 Employer's Return (wage Garnishment). Judicial Council Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WG-005 Employer's Return (Wage Garnishment) online

The WG-005 Employer's Return (Wage Garnishment) is a critical document for employers responding to a wage garnishment order. This guide provides a step-by-step approach to accurately complete the form, ensuring compliance and protection against penalties.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the WG-005 form and open it for editing.

- Enter your contact information as the attorney or party without attorney at the top of the form, including your name, State Bar number, and address.

- Fill in the name and address of the levying officer and optionally provide a fax number.

- Input your telephone number and optional email address for correspondence.

- Specify the attorney name for the involved parties, if applicable.

- Complete the jurisdictional information by filling in the superior court's name, street address, mailing address, city and zip code, branch name, and case number.

- Identify the plaintiff or petitioner and the defendant or respondent as outlined on the form.

- Mention the levying officer file number associated with the wage garnishment order.

- In the employer section, enter the name and address of the employer. Also, list the name and address of the employee, and indicate the appropriate attention designation.

- Provide the social security number of the employee if known.

- Indicate the date on which you received the Earnings Withholding Order.

- Answer whether the employee is employed by your organization: Mark 'not employed' if applicable, and if the employee is employed, fill in the gross earnings for the last pay period.

- Specify the employee's pay period by selecting the appropriate option (daily, weekly, every two weeks, etc.).

- If there are no other orders affecting the employee's earnings, omit certain sections and proceed to the declaration.

- If other orders exist, provide details regarding the priority of the earnings withheld and the nature of these other orders.

- Conclude the form by entering the date and typing or printing your name, followed by your signature as the declarant.

- After completing all sections, save changes, download, print, or share the form as needed.

Complete your wage garnishment documents online to ensure compliance.

pay off the debt. settle the debt. discharge the debt in Chapter 7 bankruptcy. pay some or all of the debt through a Chapter 13 repayment plan, or. successfully ask the state court to stop the garnishment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.