Loading

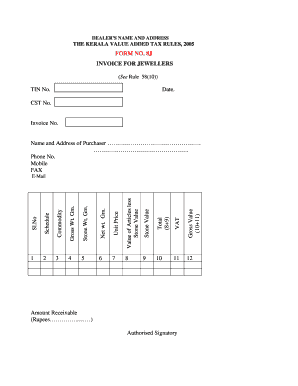

Get The Kerala Value Added Tax Rules, 2005 Form No. 8e ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the THE KERALA VALUE ADDED TAX RULES, 2005 FORM NO. 8E online

This guide provides a clear and user-friendly approach to completing THE KERALA VALUE ADDED TAX RULES, 2005 FORM NO. 8E online. By following these detailed steps, users can ensure that their submissions are accurate and compliant with requirements.

Follow the steps to complete the form online effortlessly.

- Press the ‘Get Form’ button to access the form and open it in an online editor.

- Start by filling in the dealer's name and address in the designated fields. Ensure that all information is current and accurate.

- Enter the TIN number in the specified field.

- Fill in the date of the invoice and the CST number where indicated.

- Input the invoice number for this transaction in the appropriate box.

- Provide the name and address of the purchaser in the designated section.

- Include contact details such as the phone number, mobile number, and fax number as required.

- For each item being invoiced, complete the table starting with the serial number, followed by the schedule and commodity descriptions.

- Record the gross weight in grams, stone weight in grams, and net weight in grams for each entry.

- Fill in the unit price for each commodity listed.

- Calculate the value of the articles less stone value and enter that in the corresponding field.

- Specify the stone value for each item and compute the total value by adding the previous two values.

- Calculate VAT based on the totals provided and complete the gross value field by adding VAT to the total value.

- Lastly, include an email address for communication purposes.

- Once all fields are filled out, review your entries for accuracy. You can then save changes, download the completed form, print it, or share it as necessary.

Complete your documents online today for a smooth filing experience.

Yes, VAT (Value Added Tax) is still applicable in India after the implementation of the Goods and Services Tax (GST).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.