Loading

Get Application For Deferment Individuals Sars Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Deferment Individuals Sars Form online

Filling out the Application For Deferment Individuals Sars Form online is a straightforward process that enables users to apply for a deferment of duty and value-added tax payments. This guide provides clear, step-by-step instructions to help users accurately complete the form with ease.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access and open the Application For Deferment Individuals Sars Form in an online editor.

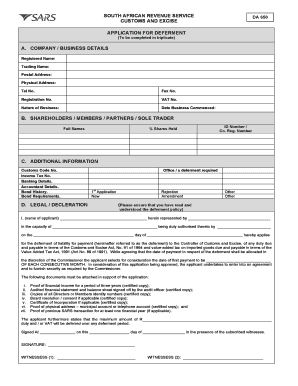

- Begin with the A. Company / Business Details section. Here, provide the registered name, trading name, and both postal and physical addresses of your business. Also, include your telephone number, fax number, registration number, VAT number, nature of business, and the date your business commenced.

- Move to B. Shareholders / Members / Partners / Sole Trader. Fill in the full names of the shareholders or members, the percentage of shares held, and the ID number or company registration number associated with each individual.

- Proceed to C. Additional Information. Enter your Customs Code number, the office where deferment is required, your Income Tax number, and your banking details. Additionally, provide information about your accountant and any relevant bond history or requirements.

- In section D. Legal / Declaration, select whether this is a new application, rejection, amendment, or other. Clearly indicate the name of the applicant, their representative, and their capacity. Specify the agreed date for the payment of the deferment and state the maximum amount of duty and/or VAT to be deferred.

- Ensure all required supporting documents are attached as specified in the guidelines, including proof of financial income for the last three years, audited financial statements, identity numbers, and proof of previous SARS transactions if applicable.

- After completing the form, review all entries for accuracy. Once verified, you can save your changes. You may also choose to download, print, or share the form as needed.

Complete your Application For Deferment Individuals Sars Form online today for a smooth filing experience.

A deferment account can be used to delay paying customs duty, excise duty and import VAT, by allowing importers to make one consolidated monthly direct debit payment in the following month, instead of paying for each individual consignment separately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.