Loading

Get Win Loss Request Form 2014.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Win Loss Request Form 2014.doc online

Filling out the Win Loss Request Form 2014 online is a straightforward process that allows users to request their gaming statements efficiently. This guide provides clear step-by-step instructions to ensure that you complete the form correctly and submit it without hassle.

Follow the steps to effectively complete the Win Loss Request Form.

- Press the ‘Get Form’ button to obtain the Win Loss Request Form and open it in your preferred online document editor.

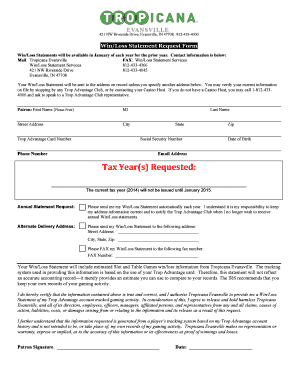

- Begin by filling in your personal information at the top of the form. Enter your first name, middle initial, last name, street address, city, state, and zip code. Also, make sure to provide your Trop Advantage card number, phone number, email address, and date of birth.

- Next, specify the tax year or years for which you are requesting your Win/Loss Statement. Please be aware that the current tax year (2014) will not be issued until January 2015.

- If you wish to receive your Win/Loss Statement automatically each year, check the box indicating this preference. It is important to keep your address information current and to inform the Trop Advantage Club if you wish to discontinue receiving annual statements.

- If you would like your Win/Loss Statement sent to a different address, fill in the alternate delivery address section, including street address, city, state, and zip code.

- If you prefer to receive your Win/Loss Statement via fax, enter your preferred fax number in the respective section.

- Review the statement regarding the accuracy of the gaming information provided and your agreement to the terms. Ensure that you understand that the statement is an estimate and not an official accounting record.

- Sign the form by providing your signature and the date at the bottom of the document. This signature certifies that the information you provided is accurate.

- After completing the form, save your changes, and download, print, or share the document as needed.

Complete your request for Win/Loss statements online today for a seamless experience!

You will directly request the WIN LOSS statement from the or gambling establishment. If you have received gambling winnings exceeding $600 during the tax year, the W-9 form will be sent to the gambling entity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.