Loading

Get Pre-authorized Payment Plan Application - City Of Windsor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pre-Authorized Payment Plan Application - City Of Windsor online

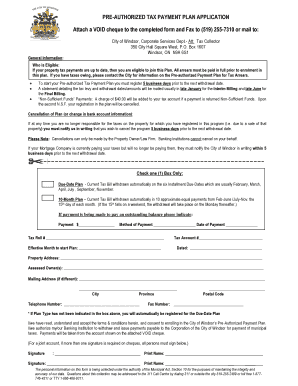

The Pre-Authorized Payment Plan Application from the City of Windsor allows you to automate your property tax payments, ensuring they are paid on time without manual intervention. This guide will provide you with a clear, step-by-step process to complete the application online.

Follow the steps to fill out the Pre-Authorized Payment Plan Application.

- Use the ‘Get Form’ button to access the document and open it in your preferred editing tool.

- Begin filling out the form by checking one box to indicate your preferred payment plan: either the Due-Date Plan or the 10-Month Plan.

- If applicable, provide details for any outstanding balance by filling in the payment amount, payment method, and date of payment.

- Enter your Tax Roll Number and specify the effective month from which the payment plan should start.

- Complete the Tax Account Number field, and date the form appropriately.

- Fill in the property address along with the assessed owner(s) information.

- If different, provide the mailing address where correspondence should be sent, including city, province, and postal code.

- Include your telephone number and fax number for verification and communication purposes.

- Ensure that you read and accept the terms and conditions of the payment plan before signing.

- Both owners must sign the form if the account is joint; include printed names next to the signatures.

- Attach a VOID cheque to the completed form as instructed and confirm the accuracy of all information prior to submission.

- Once all fields are completed, save your changes, and you can then download or print the form for faxing or mailing to the City of Windsor.

Complete your Pre-Authorized Payment Plan Application online for a hassle-free tax payment experience.

Windsor Property Taxes Residential Property Tax Rate for Windsor from 2010 to 2022YearMunicipal RateFinal Tax Rate20211.665668%1.818668%20201.622679%1.775679%20191.628394%1.789394%10 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.