Loading

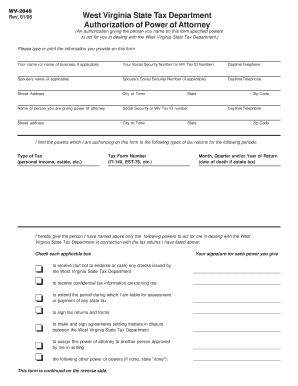

Get Wv-2848 West Virginia State Tax Department Authorization Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WV-2848 West Virginia State Tax Department Authorization of Power of Attorney online

The WV-2848 form is essential for granting authority to someone to act on your behalf with the West Virginia State Tax Department. This guide provides clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name (or the name of your business if applicable) in the designated field. This ensures that the correct individual or entity is specified as granting the power of attorney.

- Enter your Social Security Number or West Virginia Tax ID Number. This information is crucial for identification purposes.

- Include your daytime telephone number. This will allow the tax department or the authorized agent to reach you if necessary.

- If applicable, fill in your spouse's name and Social Security Number, along with their daytime telephone number, to provide additional identification for this authorization.

- Enter your complete street address, city or town, to ensure accurate correspondence with the tax department.

- Identify the individual you are granting power of attorney to by filling in their name, Social Security or West Virginia Tax ID Number, street address, city or town, state, zip code, and daytime telephone number. This identifies the authorized representative clearly.

- Limit the powers granted by specifying the types of tax returns and the respective periods you are authorizing. Include the type of tax, tax form number, and relevant dates for clarity.

- Select the boxes next to the powers you wish to grant to the authorized person. Ensure to review these selections carefully.

- Sign the form where indicated to authorize the stated powers. Ensure you date the form, and include your daytime telephone number.

- If applicable, your spouse must also sign the form if joint returns are involved.

- For corporate, partnership, or fiduciary approvals, include the signature and title of the authorized individual, along with the date and daytime telephone number.

- Complete either the witness or notary section as required, ensuring compliance with the signature witnessing or notarization requirements.

- Once all information is filled out, review the form for accuracy. Save your changes, download a copy for your records, and consider printing the completed form for submission.

- Finally, ensure the form is mailed to the West Virginia State Tax Department at the specified address.

Start completing your WV-2848 form online today for efficient tax management.

The West Virginia Tax Identification Number is your nine character ID number plus a three digit adjustment code. Personal Income Tax filers should enter '000' in this field. Business filers are defaulted to '001'.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.