Loading

Get Form 48845

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 48845 online

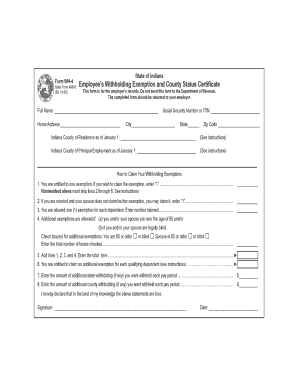

Filling out the Form 48845 is a vital step in managing your withholding exemptions and county status in Indiana. This guide provides a comprehensive overview of the necessary steps to complete the form accurately and efficiently online.

Follow the steps to complete the Form 48845 effectively.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Begin filling out the form by entering your full name, Social Security number or Individual Taxpayer Identification Number (ITIN), and home address in the designated fields.

- Specify your city, state, and zip code in the corresponding sections.

- Indicate your Indiana county of residence as of January 1 in the provided field.

- Next, enter your Indiana county of principal employment as of January 1.

- Proceed to claim your withholding exemptions by following the provided instructions: Enter '1' if you wish to claim one exemption.

- If you are married and your spouse does not claim their exemption, enter '1' under the appropriate section.

- For dependents, enter the number you wish to claim according to the defined criteria.

- If applicable, check the boxes for any additional exemptions related to age or blindness for you or your spouse.

- Calculate the total number of exemptions by adding the amounts from the previous lines and enter the total in the designated area.

- If you have additional qualifying dependents, complete this section as well.

- In the final fields, enter any additional amount you wish to have withheld for state and county taxes each pay period.

- Review your completed form for accuracy before proceeding to save changes, download, print, or share the form.

Complete your Form 48845 online today for efficient management of your withholding exemptions.

Related links form

The Indiana Form WH-4, Employee's Withholding Exemption and County Status Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages. ... If for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.