Loading

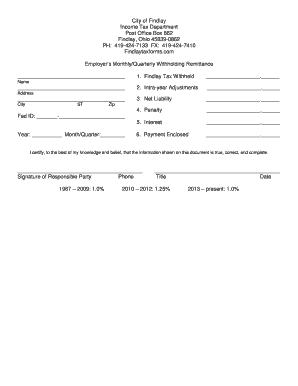

Get Monthly/quarterly Withholding - City Of Findlay

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Monthly/Quarterly Withholding - City Of Findlay online

Filling out the Monthly/Quarterly Withholding form for the City of Findlay is a straightforward process that ensures compliance with local income tax regulations. This guide provides clear steps to assist users in accurately completing the form online.

Follow the steps to successfully complete your withholding form.

- To begin, click the ‘Get Form’ button to access the Monthly/Quarterly Withholding form and open it in your preferred editor.

- In the first field, labeled 'Findlay Tax Withheld', enter the total amount of income tax withheld for the reporting period.

- If there are any intra-year adjustments that need to be made, document these in the section labeled 'Intra-year Adjustments'.

- Next, calculate your 'Net Liability' by factoring in your withheld amounts and any adjustments. Input this figure in the designated area.

- If applicable, include any penalties in the 'Penalty' field. Ensure you understand the reason for the penalty if one is assessed.

- You may also have to report any interest accrued on late payments in the 'Interest' section. Fill in the appropriate amount.

- In the 'Payment Enclosed' field, indicate the total payment amount you are submitting alongside this form, if any.

- Complete the personal information section, providing your name, address, city, state, zip code, and federal ID number.

- Indicate the year and the month or quarter applicable to this filing in the respective fields.

- Once all fields are completed, sign the document in the 'Signature of Responsible Party' area, and provide your title and phone number.

- Finally, review all provided information for accuracy. Save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your Monthly/Quarterly Withholding form online today for a seamless filing experience.

The tax generally applies to: Wages, salaries, and other compensation earned by residents of the municipality and by nonresidents working in the municipality. Net profits of business (both incorporated and unincorporated) attributable to activities in the mu nicipality.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.