Loading

Get Rd-108t Trade In Credit Form - State Of Michigan - Mich

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the RD-108T TRade In Credit Form - State Of Michigan - Mich online

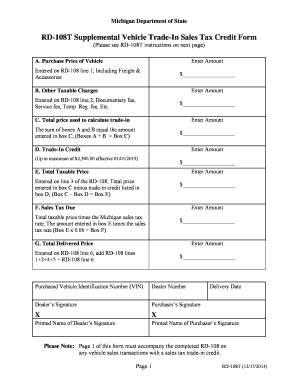

The RD-108T Trade In Credit Form is an essential document for individuals looking to claim a sales tax credit when trading in a vehicle in the state of Michigan. This guide will help users navigate the fields of the form effectively, ensuring a smooth and simplified filing process.

Follow the steps to complete the RD-108T Trade In Credit Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Box A, enter the purchase price of the vehicle. This should include any freight charges and accessories that were factory-installed. Reference the RD-108 form to ensure accurate reporting.

- In Box B, list any other taxable charges such as documentary fees, service fees, or temporary registration fees. Be sure to include any specific fees required by CVR dealers.

- Calculate Box C by adding the amounts entered in Box A and Box B. This total will be used to compute the trade-in credit and taxable price.

- In Box D, indicate the trade-in credit amount. This can be up to $2,500.00 for transactions effective January 1, 2015. Ensure this amount represents the agreed value of the trade-in vehicle.

- For Box E, subtract the trade-in credit in Box D from the total in Box C. This value represents the total taxable price of the transaction.

- In Box F, calculate the sales tax due by taking the amount in Box E and multiplying it by the Michigan sales tax rate of 0.06.

- Finally, complete Box G by reporting the total delivered price, which is calculated by adding the relevant lines from the RD-108 as specified in the instructions.

- Upon completion, save any changes made to the form, and explore options to download, print, or share the document as required.

Complete your RD-108T Trade In Credit Form online today for a hassle-free vehicle trade-in experience.

Sales tax trade-in credit Beginning January 1, 2023, owners trading in a motor vehicle receive a sales tax credit for the vehicle's trade-in value up to a maximum of $9,000. This amount increases $1,000 annually and is based on the delivery date of the vehicle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.