Loading

Get De 4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the De 4 Form online

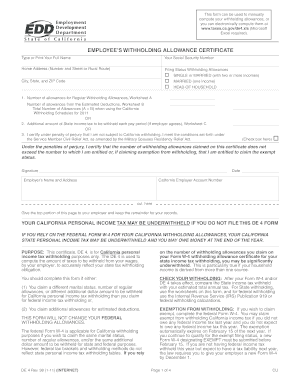

The De 4 Form, officially known as the Employee’s Withholding Allowance Certificate, is essential for determining your state income tax withholding in California. This guide provides a step-by-step approach to filling out the form online, ensuring that you understand each section with ease.

Follow the steps to accurately complete the De 4 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by typing or printing your full name in the designated section at the top of the form.

- Enter your Social Security number in the appropriate field.

- Provide your home address, including the number and street or rural route.

- Select your filing status by checking one of the options: SINGLE or MARRIED (with two or more incomes), MARRIED (one income), or HEAD OF HOUSEHOLD.

- Fill in your city, state, and ZIP code.

- Calculate the number of allowances for regular withholding (Worksheet A), enter this in the designated field.

- If applicable, enter the number of allowances from estimated deductions (Worksheet B). Add both values from Steps 7 and 8 to get the total number of allowances.

- Alternatively, you can indicate an additional amount of state income tax to be withheld each pay period, referring to Worksheet C.

- If claiming exemption from withholding under the Service Member Civil Relief Act, check the provided box.

- Sign and date the form to certify the accuracy of the information provided.

- Provide your employer's name and address, and include their California Employer Account Number.

- Ensure you understand that the top portion of this page should be given to your employer while keeping the remainder for your records.

- Once completed, you can save any changes, download, print, or share the form as needed.

Complete your De 4 Form online today to ensure accurate tax withholding!

2. Withholding Allowances Are Gone. The thing that really separates the 2020 W-4 form from the 2019 and earlier forms is the elimination of withholding allowances. ... Instead of claiming withholding allowances to reduce federal income tax withholding, employees can now claim dependents or other deductions on the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.