Loading

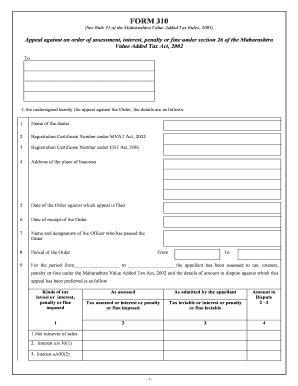

Get Form 310 (see Rule 31 Of The Maharashtra Value Added Tax Rules, 2005) Appeal Against An Order Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM 310 (See Rule 31 Of The Maharashtra Value Added Tax Rules, 2005) Appeal Against An Order Of online

Filing an appeal against an order of assessment, interest, penalty, or fine can be a straightforward process when using the FORM 310 under the Maharashtra Value Added Tax Rules, 2005. This guide will provide clear instructions on how to complete the form online, ensuring that you understand each section thoroughly.

Follow the steps to accurately complete FORM 310 online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your name in the designated field labeled 'Name of the dealer'. This is important as it identifies who is filing the appeal.

- Next, provide your Registration Certificate Number under the MVAT Act, 2002. Make sure this number is accurate to avoid any delays in processing.

- Also, include your Registration Certificate Number under the CST Act, 1956 if applicable. This information links your appeal with your tax registration.

- Fill in the address of your place of business. This should be the location registered under the MVAT.

- Record the date of the order against which you are filing the appeal. This is the official document date of the assessment, penalty, or fine.

- Indicate the date you received the order. This helps track the timeline of your appeal.

- Enter the name and designation of the officer who issued the order. Ensure that you have this information correct to correspond effectively.

- Specify the period covered by the order. Use the two fields given to indicate the exact dates.

- Identify the kinds of taxes, interest, or penalties that are being disputed. Enter amounts in the specified fields to differentiate between assessed and admitted amounts.

- Detail the quantum of relief you seek, which is the sum of amounts you want refunded or the adjustments you'd like to see made.

- Attach a notice of demand and a certified copy of the order appealed against to support your case.

- If applicable, provide details of any prior appeals and their outcomes, ensuring clarity on your appeal history.

- Conclude by stating the grounds for your appeal and the specific relief you are seeking. Make sure this is articulated clearly.

- Finally, review all entered information for correctness, then save the changes, download the completed form, print it for your records, or share it as required.

Complete your FORM 310 appeal online today for a smooth filing experience.

Important Aspects of New VAT Audit Form -704 For non filing or late filing of the Audit Report, penalty at the rate of 0.1% of the turnover of sales is also leviable. As explained from beginning, under VAT Act the assessments will be sparing, based on selection criteria.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.