Loading

Get Example Of Complete Form 4506 W

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Example Of Complete Form 4506 W online

Filling out the Example Of Complete Form 4506 W online can streamline your request for tax transcripts or other return information from the IRS. This guide provides you with clear, step-by-step instructions to successfully complete the form, ensuring your submission is accurate and complete.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to obtain the Example Of Complete Form 4506 W and open it in your editing interface.

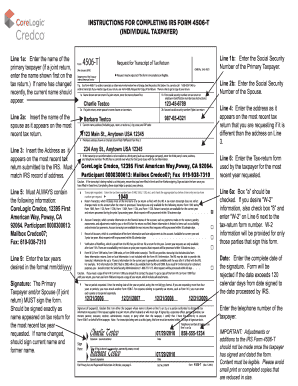

- In Line 1a, enter the name of the primary taxpayer. If this is a joint return, provide the name that is shown first on the tax return. If there has been a recent name change, ensure you enter the current name.

- In Line 1b, input the Social Security Number of the primary taxpayer. This is essential for identification and record retrieval.

- Proceed to Line 2a and enter the name of the spouse, as indicated on the most recent tax return, if applicable.

- Fill in Line 2b with the Social Security Number of the spouse as well. This confirms the identity of both taxpayers.

- In Line 3, provide your current mailing address including any apartment or suite number, city, state, and ZIP code, ensuring it matches the IRS records.

- If your address has changed since the last return, indicate the previous address in Line 4.

- Line 5 should include the third party’s name and contact information if the transcript or tax information is to be mailed to someone other than you.

- In Line 6, specify the tax return form number you are requesting, such as 1040, and check the appropriate box to indicate the type of transcript needed.

- Enter the tax years you are requesting in Line 9 using the mm/dd/yyyy format. If you are requesting more than four years, attach another Form 4506 W.

- Ensure you sign the form in the signature area. If it’s a joint return, both taxpayers need to sign. Remember to sign in the same name as it appeared on the tax return.

- Once completed, review all information for accuracy. You can then save your changes, download, print, or share the form as needed.

Begin your online document submission process today!

A form 4506-T simply allows your lender to verify with the IRS that the forms you supply to prove your income match those in the possession of the IRS. ... The IRS can provide a transcript that includes data from these information returns. State or local information is not included with the Form W-2 information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.