Loading

Get Adp Rollover Form 280

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Adp Rollover Form 280 online

Filling out the Adp Rollover Form 280 online can be a straightforward process if you follow the right steps. This guide provides a detailed, user-friendly approach to completing each section of the form, ensuring that your rollover goes smoothly.

Follow the steps to successfully complete the rollover form.

- Click ‘Get Form’ button to obtain the form and open it in the form editor.

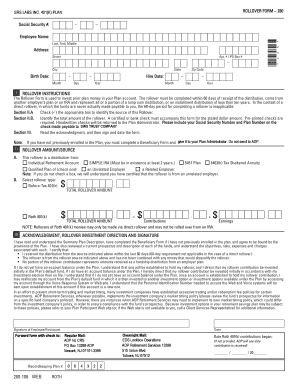

- Begin by entering your Social Security number in the designated field. Ensure correct entry to avoid any processing delays.

- Fill in your name as Last, First, Middle in the Employee Name section.

- Provide your current address, including street, apartment or PO Box number, city, state, and zip code.

- Enter your birth date in the Month, Day, Year format.

- Input your hire date also in the Month, Day, Year format.

- In Section II.A, check the appropriate box to identify the source of your rollover, such as an Individual Retirement Account or a Qualified Plan.

- In Section II.B, specify the total rollover amount. Note that a certified or bank check must accompany the form to the stated dollar amount.

- Proceed to Section III. Read the acknowledgment carefully and sign and date the form.

- If you have not previously enrolled in the Plan, be sure to complete a Beneficiary Form and submit it to your Plan Administrator.

- Once all fields are completed, you can save changes, download, print, or share the form as required.

Complete your documents online to ensure a smooth rollover process.

Form a C Corporation. ... Open a 401(k) plan for your new business. ... Roll over funds from your old retirement plan to the new one. ... Issue stock (ownership shares) in the new C-corp, which the retirement plan purchases. ... Follow the rules.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.