Loading

Get Westpac Income Verification Requirements Matrix For Mortgages ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WESTPAC INCOME VERIFICATION REQUIREMENTS MATRIX FOR MORTGAGES online

Filling out the Westpac Income Verification Requirements Matrix for Mortgages can seem daunting. This guide offers clear and comprehensive instructions to help users navigate the document with confidence and clarity.

Follow the steps to effectively complete the form.

- To begin, click the ‘Get Form’ button to access the Westpac Income Verification Requirements Matrix. This will open the form in your preferred online editor.

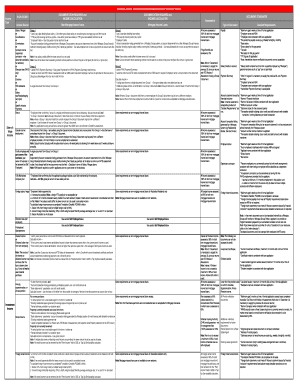

- Review the form sections carefully. Each section pertains to different income types, such as salary, wages, bonuses, and other income sources. Ensure you are familiar with these terms to avoid confusion.

- In the income type section, select the appropriate category that reflects your income source. Each category will have specific documentation requirements listed below.

- For each chosen income type, gather the necessary documents as specified. For example, for salary or wages, you may need the last two pay slips, your YTD pay slip, or an employer's letter.

- Carefully document your income calculations based on the guidelines provided. Ensure you include all requested details and follow the note provisions regarding variations in income amounts.

- Cross-check your entries and documentation against the listed requirements in the matrix to confirm that all necessary information and documentation have been provided.

- Once you have completed the form, save your changes. You can also choose to download, print, or share the completed form based on your needs.

Take the next step in your mortgage application by filling out the required documents online today.

A lender will always require you provide bank statements as part of your mortgage application. Bank statements give a lender an up close and personal view of your finances — which is crucial when determining just how much money you can qualify for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.