Loading

Get What Is A Request For Written Statement Of Taxes Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is A Request For Written Statement Of Taxes Form online

This guide provides users with straightforward instructions to complete the Request For Written Statement Of Taxes Form online. By following these steps, you can ensure that your request is accurately and efficiently submitted to receive the necessary tax information.

Follow the steps to complete the Request For Written Statement Of Taxes Form.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

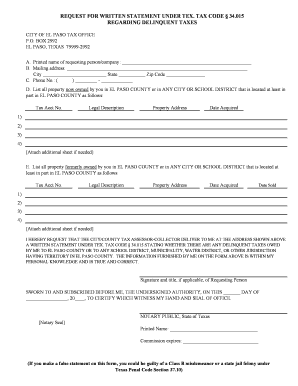

- In section A, enter the printed name of the requesting person or company. Make sure to provide the full name to ensure clarity.

- In section B, fill in the mailing address where you want to receive the information. Include the city, state, and zip code for accurate delivery.

- In section C, provide a phone number where you can be reached. This should be formatted as (XXX) XXX-XXXX.

- In section D, list all properties currently owned by you in El Paso County or in any city or school district located at least partly in El Paso County. Enter the tax account number, legal description, property address, and date acquired for each property. If you have more than four properties, attach an additional sheet.

- In section E, record all properties that you previously owned in El Paso County or in any city or school district within El Paso County. Similar to section D, provide the tax account number, legal description, property address, date acquired, and date sold for each property. Again, attach an additional sheet if needed.

- At the end of the form, confirm your request by acknowledging that the provided information is true and correct. Ensure that you sign and date the form.

- If necessary, have a notary public witness your signature and complete the notary section to verify the authenticity of your request.

- Once you have filled out all required fields and attached any additional sheets, you can save your changes, download the completed form, print it, or share it as needed.

Complete your Request For Written Statement Of Taxes Form online today and take the first step towards managing your tax information.

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.