Loading

Get Freeport Exemption Application Package - Tarrant Appraisal District - Tad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freeport Exemption Application Package - Tarrant Appraisal District - Tad online

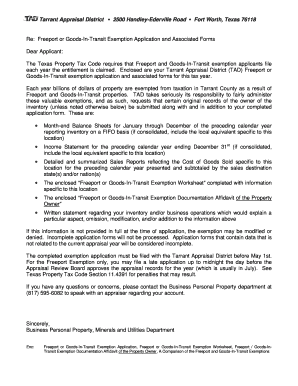

Filing the Freeport Exemption Application Package with the Tarrant Appraisal District can facilitate significant savings on property tax exemptions. This guide provides comprehensive, step-by-step instructions to help users navigate the process efficiently and correctly.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the account number associated with your property. Provide your business name and the owner's name, along with the current mailing address including street number, city, state, and ZIP code.

- Indicate the phone number of the person preparing the application and their title. Additionally, provide details about the inventory location with a complete street address.

- Next, answer the application questions regarding your inventory. Confirm whether portions of the inventory will be transported out of state and if you have applied for a September 1 inventory appraisal.

- State the total cost of goods sold for the previous year and the amount that was shipped out of Texas within 175 days.

- Specify the types of records on which you based the submitted amounts. This may include various types of financial or sales records.

- Calculate and enter the market value of your inventory as of January 1 of the current year and the value you claim will be exempt.

- Finally, sign and date the form to certify that the information provided is true and accurate. Ensure to attach any requested additional documentation before submission.

Start your application process online to ensure a thorough and timely submission.

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.