Loading

Get Change Bene Form English - Final.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Change Bene Form English - Final.doc online

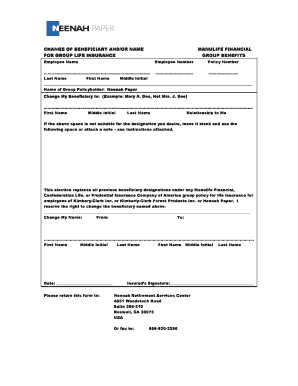

Filling out the Change Bene Form is a critical step in managing your beneficiary designations for group life insurance. This guide will walk you through each section of the form, providing clear and detailed instructions to ensure accuracy and completeness as you complete the form online.

Follow the steps to fill out the form accurately and efficiently.

- Press the ‘Get Form’ button to access the document and open it in your editor.

- Begin by entering your information in the designated fields. Provide your last name, first name, and middle initial in the appropriate spaces at the top of the form.

- Next, input your Employee Number and Policy Number in the specified fields to ensure proper identification.

- In the section labeled 'Change My Beneficiary to,' clearly write the name of the person you wish to designate as your beneficiary. Use the correct format, such as First Name, Middle Initial, and Last Name. Also include their relationship to you.

- If additional space is needed for your designation, leave the initial spaces blank and utilize the following area or attach a separate note as instructed.

- If you are changing your name, fill in the 'Change My Name' section. Enter your former first name, middle initial, and last name in the 'From' field, and your new name in the 'To' field.

- Sign and date the form in the designated areas ensuring that your signature matches your legal name.

- Once all fields are completed, review your form for any errors. Make sure all information is accurate before proceeding.

- After confirming all information is correct, you can save changes, download the completed form, print it for a physical copy, or share it as needed.

Complete your Change Bene Form online today to ensure your beneficiary designations are up to date.

If you don't designate a beneficiary, or your primary and contingent beneficiaries die before you, your surviving spouse will typically inherit your 401(k) balance. If you don't have a spouse or living beneficiaries, the funds in your account are generally turned over to your estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.