Loading

Get Hanover County 2019 Application For High Mileage Discount Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hanover County 2019 Application For High Mileage Discount Fillable Form online

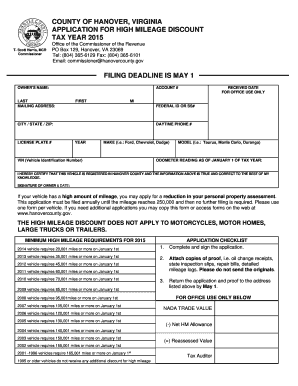

The Hanover County 2019 Application For High Mileage Discount Fillable Form allows users to apply for a reduction in personal property assessment based on high vehicle mileage. This guide provides clear, step-by-step instructions to assist you in completing the form effectively.

Follow the steps to complete the application online.

- Click ‘Get Form’ button to access the application and open it in your editor.

- Begin filling out your account number in the designated field. This is a unique identifier for your property.

- In the ‘Owner's Name’ section, enter the last name first, followed by the first name and middle initial.

- Provide your mailing address, including the city, state, and ZIP code, ensuring accuracy for correspondence.

- Fill in your Federal ID number or Social Security number in the corresponding field.

- Enter your vehicle's license plate number accurately, as this is used for identification.

- In the ‘Daytime Phone Number’ field, provide a reliable contact number where you can be reached.

- Next, list the year, make, model, and Vehicle Identification Number (VIN) of your vehicle in their respective fields.

- Input the odometer reading as of January 1 of the tax year in the appropriate section.

- Read the certification statement and confirm that all information is true to the best of your knowledge. You will need to sign and date the application in this section.

- Gather necessary supporting documents such as oil change receipts, inspection slips, or detailed mileage logs. Attach copies, not originals.

- Complete the application checklist to ensure you have fulfilled all requirements before submitting.

- Finally, save your changes, and proceed to download, print, or share the application as needed.

Complete your Hanover County application online today to take advantage of potential savings!

Falls Church city collects the highest property tax in Virginia, levying an average of $6,005.00 (0.94% of median home value) yearly in property taxes, while Buchanan County has the lowest property tax in the state, collecting an average tax of $284.00 (0.46% of median home value) per year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.