Loading

Get Boa Tnoc - Consolidated Application - Residential (11-10).docx. None - Osceolataxcollector

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the BOA TNOC - Consolidated Application - Residential (11-10) online

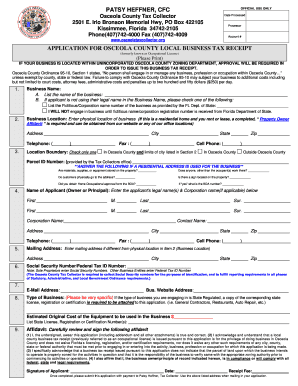

Filling out the BOA TNOC - Consolidated Application - Residential (11-10) is an essential step for individuals and businesses seeking to operate within Osceola County. This guide provides a clear, step-by-step approach to navigating the application, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully fill out the application.

- Press the ‘Get Form’ button to access the application form, which will open in your document editor for easier completion.

- Begin completing the application by clearly providing your business name in the designated field. If you are not using your legal name, indicate so by checking the appropriate option and providing any required registration numbers.

- Enter the physical location of your business accurately, including address, city, state, and zip code. If this location is a residential property, ensure to include a completed ‘Property Owner Affidavit’ as required.

- Specify the boundary of your business location by checking one of the three options provided: within Osceola County limits, within Osceola County, or outside Osceola County. Also, include your Parcel ID number.

- If your business operates from a residential address, answer the specific questions regarding equipment storage, customer visits, signage, and if you have obtained Home Occupational approval from the BOA. Include the assigned BOA number if applicable.

- Fill in the name of the applicant or principal of the business, providing legal names and corporation names if applicable. Add contact information, including telephone and email.

- If your mailing address differs from your physical location, provide this information in the designated section.

- Enter your Social Security number or Federal Tax ID number, depending on your business structure. Note that this information is required for identification purposes.

- Describe the type of business comprehensively. If applicable, attach a copy of the relevant state license or registration. Include estimated costs for equipment used in the business.

- Carefully read and sign the affidavit section, affirming that all provided information is accurate and that you comply with local regulations.

- Once all sections are completed, save your changes. You may download, print, or share the form as needed.

Complete your application online today to ensure a smooth and efficient process.

In Osceola County, a business located within a city limit requires both a municipal license and a County Local Business Tax Receipt to operate. The City of Kissimmee and City of St. Cloud can be contacted with the information below: City of Kissimmee Business Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.