Loading

Get Ahrp Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ahrp rollover form online

Completing the Ahrp rollover form online can streamline the process of transferring your retirement funds. This guide provides detailed instructions to ensure that you can effectively fill out each section of the form with confidence and accuracy.

Follow the steps to complete the Ahrp rollover form online

- Press the ‘Get Form’ button to obtain the form and open it on your device.

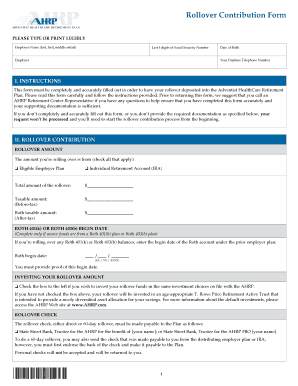

- Fill in your personal details at the top of the form, including your employee name, last four digits of your Social Security number, employer, date of birth, and daytime telephone number.

- In Section I, read the instructions carefully and ensure you understand the requirements for your rollover contribution to be processed.

- Proceed to Section II. Indicate the amount you are rolling over by checking the appropriate boxes for either an eligible employer plan or an individual retirement account (IRA). Fill in the total amount of the rollover and specify the taxable and Roth taxable amounts if applicable.

- If rolling over Roth 401(k) or Roth 403(b) funds, complete the begin date section with the date the account was established at your prior employer.

- In Section III, certify the accuracy of your statements regarding eligibility. Ensure that you check all required confirmations correctly.

- Sign and date the form to confirm your agreement to the terms specified in the form.

- Review all completed sections for accuracy, then gather and include the required documentation that shows the eligibility of the rollover amount.

- Mail the completed original form along with the required documentation and rollover amount to the specified address in Section IV. Keep a copy of everything for your records.

Start filling out your Ahrp rollover form online today to ensure a smooth rollover process.

Rolling over a 401(k) to a new employer is fairly straightforward — you simply call the 401(k) provider at your old company and request the rollover yourself or your current employer plan can do it for you. The other option, which is rolling over a 401(k) into an IRA, is also a popular choice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.