Loading

Get Application For Rebate Of Property Taxes - Chatham-kent - Chatham-kent

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Rebate Of Property Taxes - Chatham-Kent online

This guide provides clear instructions for completing the Application For Rebate Of Property Taxes specific to Chatham-Kent, ensuring you understand each component of the form. Following these steps will help you successfully complete the application online, making the process efficient and straightforward.

Follow the steps to complete your application online with ease.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online document editor.

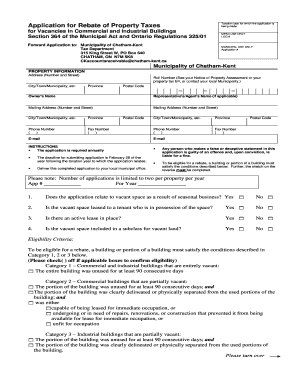

- Provide the taxation year for which you are applying for the rebate. Ensure that you have the correct year as it is essential for processing.

- Fill in the property information, including the address, city, roll number, province, and postal code. The roll number can be found on your property tax bill or assessment notice.

- Enter the owner's name in the designated field. If a representative or agent is completing this form on behalf of the owner, include their name in the appropriate section.

- Complete the mailing address fields accurately, including the street number, city, province, and postal code. This will be used for any correspondence.

- Provide contact details, including phone and fax numbers, as well as an email address for notifications regarding your application.

- Indicate if the application relates to vacant space due to seasonal business by selecting ‘Yes’ or ‘No’.

- Answer the questions regarding the lease status of the vacant space, including whether it is leased to a tenant who is in possession and if an active lease exists.

- Check the appropriate eligibility criteria for the property based on its vacancy status, ensuring to meet conditions stipulated in Categories 1, 2, or 3.

- Include a detailed sketch of the vacant unit, marking the size and description of the area clearly. Attach a separate page if needed.

- Specify the period of vacancy, ensuring it spans at least 90 consecutive days. Enter the start and end dates accurately.

- Certify the application by signing and dating the form. This declaration confirms that the information provided is true and correct.

- Review the completed application for accuracy before submitting.

- Once satisfied with the form, save the document, and prepare to download, print, or share it as required for submission.

Complete your application online today and ensure your eligibility for a property tax rebate.

The rebate amount is based on your municipal residential property taxes. The program provides eligible homeowners with a rebate of 50% of the municipal residential property taxes they paid for the 2021 tax year, up to a maximum of $800.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.