Loading

Get Nebraska Personal Property Return Form - Lancaster, Ne - Lancaster Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Personal Property Return Form - Lancaster, NE - Lancaster Ne online

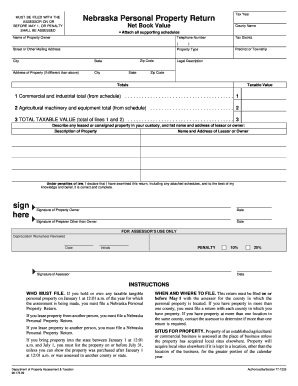

This guide provides comprehensive instructions on filling out the Nebraska Personal Property Return Form for Lancaster County. Whether you are a business owner or a property manager, this step-by-step approach will ensure the process is seamless and thorough.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the Nebraska Personal Property Return Form and open it in your preferred editing tool.

- Begin by entering your county name. This should reflect where your property is located.

- Fill out the contact information including your telephone number, street address, and any relevant mailing address if different.

- Select the type of property you are reporting. Clearly categorize whether it is commercial, industrial, or agricultural machinery.

- Under the legal description section, provide specific information about the property’s location.

- Calculate the total taxable value by summing the commercial and industrial totals and agricultural totals from the appropriate schedules.

- Review the declaration section, ensuring that all details are accurate before signing. This must be signed by the property owner or the preparer.

Complete your Nebraska Personal Property Return Form online now to ensure timely submission and avoid penalties.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.