Loading

Get Questionnaire For Exemption From Tax Withholdings For Construction ... - Dmuhmci148vcw Cloudfront

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Questionnaire for Exemption From Tax Withholdings for Construction ... - Dmuhmci148vcw Cloudfront online

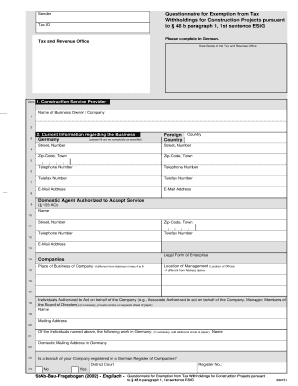

Completing the Questionnaire for Exemption From Tax Withholdings for Construction Projects is crucial for ensuring compliance with tax regulations in Germany. This guide provides clear and detailed steps to help users effectively fill out the form online.

Follow the steps to successfully complete the questionnaire.

- Click 'Get Form' button to access the questionnaire and open it in your online editing tool.

- Enter the sender's tax ID in the designated field. Ensure that this information is accurate as it is required for tax identification purposes.

- Fill in the name of the construction service provider. This field requires the business owner’s or company’s name.

- Provide current information regarding the business, including the street address, zip code, town, and contact details such as telephone and email.

- Identify the domestic agent authorized to accept service. Include their name, address, and contact information.

- Outline the legal form of your enterprise and the place of business if it differs from the previous address.

- List names of individuals authorized to act on behalf of the company, with an option to provide additional names on a separate sheet.

- Indicate the number of employees currently employed in Germany, and specify how many of those are residents and how many are foreign residents working in Germany.

- Detail the location of the accounting records related to the business conducted in Germany.

- Provide the date of the start of the construction work, the expected duration, and other relevant details about the construction project.

- Answer questions related to tax assessments by other German Tax and Revenue Offices, if applicable.

- Make sure to review all provided information for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out your questionnaire online today to ensure your tax compliance for construction projects.

Income Tax Withholding on Your W-4 to Lower Your Tax Bill. Proper planning will help you keep more of your paycheck and pay less to the Internal Revenue Service (IRS) each year. You control how much is withheld from your paycheck. ... Too much: If you get a refund, you had too much withheld from your paycheck.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.