Loading

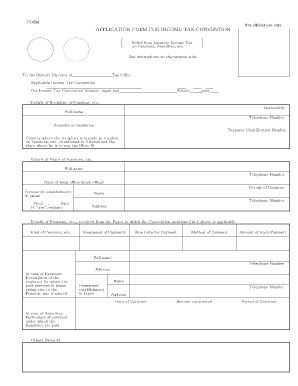

Get Application Form For Income Tax Convention

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application Form For Income Tax Convention online

Filling out the Application Form For Income Tax Convention correctly is essential for individuals seeking relief from Japanese income tax on pensions and annuities. This guide provides a step-by-step approach to help you navigate the form with ease.

Follow the steps to complete your application form accurately.

- Press the ‘Get Form’ button to access the application form and open it in your preferred document editing software.

- Begin with the section labeled 'Applicable Income Tax Convention.' Here, specify the income tax convention applicable between your country and Japan, including the article and paragraph details.

- In 'Details of Recipient of Pensions, etc.,' provide information such as your nationality, full name, telephone number, domicile or residence, taxpayer identification number (if you have one), and the country where you are taxable as a resident.

- Next, move to 'Details of Payer of Pensions, etc.' and fill in the full name and telephone number of the payer, along with the location of their head office.

- Complete the section titled 'Details of Pensions, etc., received from the Payer.' Specify the kind of pensions, payment frequency, due date for payment, method of payment, and the amount of each payment.

- If applicable, provide details regarding 'In case of Pensions' and 'In case of Annuities.' For pensions, include the description of the employer and for annuities, offer particulars of the contract under which the annuities are paid.

- Under the declaration section, affirm the accuracy of the provided information to the best of your knowledge. Ensure to sign where indicated and provide your capacity if you are submitting through an agent.

- Finalize your form by reviewing all entries for accuracy. Once completed, save the changes, and you may choose to download, print, or share the form as necessary.

Complete and submit your Application Form For Income Tax Convention online today for a smoother tax relief process.

Because of the US-UK tax treaty, most Americans living in the UK are already exempt from double taxation. However, the IRS also provides several other potential tax credits and deductions for expats, such as: Foreign Earned Income Exclusion. Foreign Tax Credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.