Loading

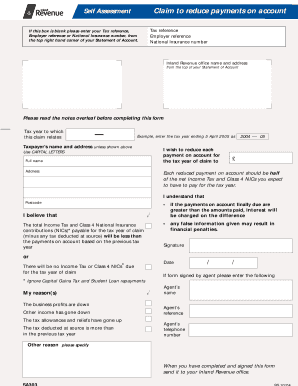

Get Claim To Reduce Payments On Account

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claim To Reduce Payments On Account online

Filling out the Claim To Reduce Payments On Account form online can streamline the process of adjusting your payment obligations based on your current financial situation. This guide provides users with a step-by-step overview to ensure a smooth and accurate submission.

Follow the steps to effectively complete your claim online.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter your tax reference, employer reference, or National Insurance number in the Self Assessment section. If the box is blank, refer to the top right corner of your Statement of Account.

- Input the Inland Revenue office name and address, taken from the top of your Statement of Account.

- Specify the tax year to which this claim relates, using the format indicated (e.g., 2004-05 for the tax year ending 5 April 2005).

- Provide your full name and address in the designated section using CAPITAL LETTERS.

- Indicate the amount you wish to reduce each payment on account for the tax year of your claim, ensuring this amount reflects half of the estimated net Income Tax and Class 4 NICs you expect to pay.

- Review and confirm your understanding of the implications of this claim—specifically, that if your payments on account are greater than the finally due amounts, interest will be charged on the difference.

- In the 'My reason(s)' section, select the contributing factors to your claim, such as reduced business profits or increased tax allowances.

- If applicable, provide information for your agent's name, reference, and telephone number.

- After ensuring all information is accurate and complete, sign and date the form. Make sure to send the completed form to your Inland Revenue office.

Start completing your Claim To Reduce Payments On Account online today.

If you feel your income will be lower than the previous year you can reduce your payments on account with HMRC. You will need to explain why you are reducing your payments and can set a new amount that you intend to pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.