Loading

Get Nyc 3360

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 3360 online

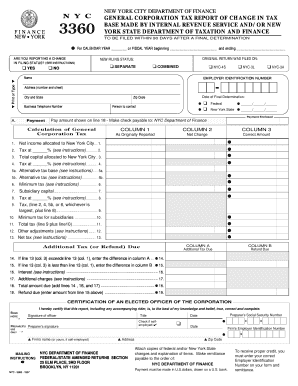

The Nyc 3360 is an essential form for reporting changes in tax bases as determined by the Internal Revenue Service or the New York State Department of Taxation and Finance. This guide provides clear, step-by-step instructions to help users complete the Nyc 3360 online with confidence.

Follow the steps to complete the Nyc 3360 online efficiently.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Identify the appropriate calendar or fiscal year for which you are reporting changes. Fill in the relevant fields for the start and end dates accurately.

- Determine your filing status by checking 'YES' or 'NO' to indicate if you are reporting a change in filing status. If applicable, provide the original return date and select your new filing status from the available options.

- Enter your business details, including the name, employer identification number, address, and contact information. Ensure all data is correctly spelled and formatted.

- Fill in the date of final determination. This date must be consistent with the final determination from the IRS or the state.

- Proceed to the calculation section, filling in the original amounts reported, net changes, and correct amounts across the appropriate columns. Pay close attention to the tax rates indicated in the instructions.

- Complete additional calculations as required, such as the alternative tax base and minimum tax, following the provided instructions closely.

- Verify all calculations and ensure that all necessary forms and schedules are attached to substantiate your reported changes.

- Once all fields are completed, review the form for any errors or omissions, save your changes, and download or print the completed form for your records.

- Finally, submit the completed form by following the filing instructions provided for timely processing.

Start preparing your Nyc 3360 online today and ensure your compliance with New York City tax regulations.

New York Tax Rates, Collections, and Burdens New York has a 6.50 percent to 7.25 percent corporate income tax rate. New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.