Loading

Get (see Rule 24 Of The Delhi Value Added Tax Rules, 2005)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form DVAT 13 online

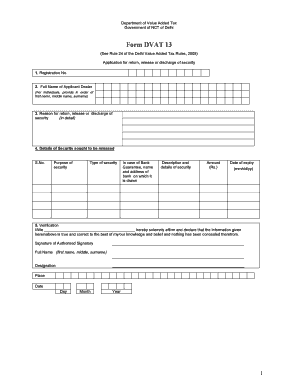

Filling out Form DVAT 13 is an essential process for anyone seeking the return, release, or discharge of security as per Rule 24 of the Delhi Value Added Tax Rules, 2005. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently, all online.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to access the form and open it in your digital workspace.

- Enter your registration number in the specified field. This number is unique to your business and is essential for identification.

- Provide your full name as the applicant dealer. If you are an individual, please list your first name, middle name (if applicable), and surname in that order.

- Detail the reason for the return, release, or discharge of security. Be thorough and specific, as this section is critical for processing your application.

- Complete the details of the security you wish to have released by filling in the related fields. Include the following information for each security item: S.No., purpose of security, type of security, for bank guarantees, the bank's name and address, a description of the security, amount in rupees, and the date of expiry in mm/dd/yy format.

- In the verification section, affirm that the information provided is true and correct by signing as the authorized signatory. Include your full name (with first name, middle, and surname), designation, place, and the date (day, month, year).

- Once all sections are completed, review your form for accuracy. You can then save your changes, download a copy, print it for your records, or share the form as needed.

Take the next step towards managing your VAT obligations—complete your Form DVAT 13 online today.

Pre-deposits -Analysis of the third proviso to Section 74(1) of Delhi VAT Act 2003. Section 74 of the Delhi VAT Act, 2003 deals with filing of objections before the Commissioner by any person who is dissatisfied with the order of an Assessment under the Act or any other order or decision made under this Act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.