Loading

Get Form1277

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form1277 online

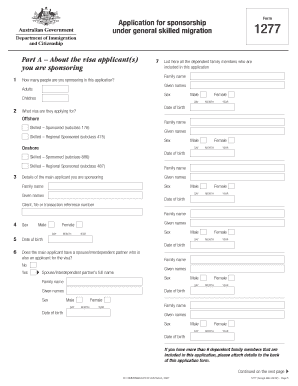

Filling out the Form1277 online is an essential step for individuals sponsoring applicants for skilled visas in Australia. This guide provides clear and concise instructions to help users navigate the form with confidence.

Follow the steps to successfully fill out the Form1277 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin with Part A, where you will provide information about the visa applicants you are sponsoring. List all dependent family members included in the application, including their names, gender, date of birth, and the specific visa they are applying for.

- Move to Part B, which focuses on your details as the sponsor. Ensure to include your full name, date of birth, citizenship status, and residential address. If your address is not in Australia, attach a statement explaining how you meet the residency requirements.

- Complete Part C concerning health and character. Answer all questions truthfully relating to any previous criminal convictions or health issues.

- Proceed to Part D, if you are sponsoring for a Skilled – Regional Sponsored visa. Provide evidence of your current residency in a designated area and confirmation of your residence over the last 12 months.

- In Part E, specify if any assistance was received during form completion and provide relevant contact details.

- Fill out Part G, where you will agree to the sponsorship conditions and ensure you sign appropriately. Ensure the date is included.

- Finally, review your completed form, save your changes, and decide on the option to download, print, or share the form as necessary.

Complete your Form1277 online today to support your skilled visa application.

The tax lien will still expire at the end of 10 years even if the IRS has more than 10 years to collect unless the IRS timely refiles the lien. If the IRS timely refiles the tax lien, it is treated as continuation of the initial lien.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.