Loading

Get 8814

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8814 online

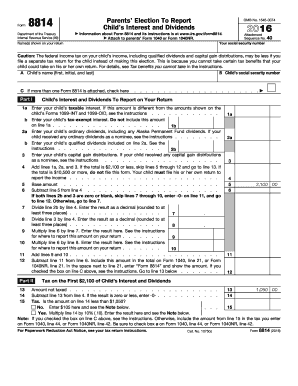

Filling out Form 8814 is an important process for parents wishing to report their child's income on their tax return. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the 8814 online

- Click ‘Get Form’ button to access the form and open it in your preferred document management tool.

- Enter the name(s) as shown on your tax return along with the corresponding social security number in the designated fields.

- Provide your child's name, including their first name, initial, and last name in Section A.

- Input your child's social security number in Section B to ensure the information is linked correctly.

- If you are submitting multiple Forms 8814, be sure to indicate this by checking the box in Section C.

- Proceed to Part I, where you will report your child's interest and dividends. Begin with line 1a, entering your child's taxable interest income.

- On line 1b, enter any tax-exempt interest received by your child, ensuring this total is not included on the previous line.

- Continue to line 2a to report ordinary dividends, and subsequently enter any qualified dividends on line 2b.

- Document any capital gain distributions received by your child on line 3.

- Add the totals from lines 1a, 2a, and 3 on line 4. If this total is $2,000 or less, skip lines 5 through 12 and move to line 13.

- If the total exceeds $10,000, you must amend your filing accordingly, as your child needs to file their own tax return.

- Follow the rest of the instructions in Part II concerning the tax on your child's income. Complete lines 13 through 15 as directed.

- Finally, ensure that any calculated amounts are reported correctly on your Form 1040 or Form 1040NR as specified.

- Once you have completed the form, save your changes, download a copy for your records, print it out if needed, or share it as required.

Start completing your Form 8814 online today for a simplified tax reporting process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You do not include their earned income on your taxes. If they earned less than $12,400 in 2020, they do not have to file a return, but may wish to do so to recover any withheld income taxes. ... A parent can elect to claim the child's unearned income on the parent's return if certain criteria are met.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.