Loading

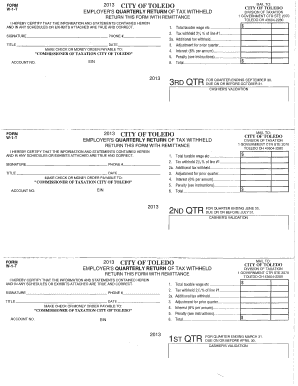

Get 2013 Quarterly Withholding Forms - City Of Toledo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2013 Quarterly Withholding Forms - City Of Toledo online

Completing the 2013 Quarterly Withholding Forms for the City of Toledo is essential for employers to report tax withheld accurately. This guide provides straightforward instructions for filling out the form online, ensuring compliance and ease for users.

Follow the steps to complete and submit your form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Identify the 'total taxable wages' section (Line 1) and enter the total wages that were subject to withholding during the quarter.

- Calculate the 'tax withheld' by taking 2% of the amount reported on Line 1 and fill it into Line 2.

- If there are any additional taxes withheld, record this amount in Line 2a.

- If you need to adjust for any prior quarter, include that adjustment in Line 3.

- Calculate the interest for any late payments at a rate of 6% per annum and record it in Line 4.

- If there are any penalties applicable, input this amount in Line 5, referring to the provided instructions if needed.

- Finally, sum all relevant amounts to display the total tax due in Line 6.

- Before submitting, ensure all required fields are completed, then save your changes, download, or print the form as necessary.

Complete your forms online to ensure timely and accurate reporting.

The tax generally applies to: Wages, salaries, and other compensation earned by residents of the municipality and by nonresidents working in the municipality. Net profits of business (both incorporated and unincorporated) attributable to activities in the mu nicipality.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.