Loading

Get Public Works Payroll Reporting Form (a-1-131) - California ... - Dir Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Public Works Payroll Reporting Form (A-1-131) - California online

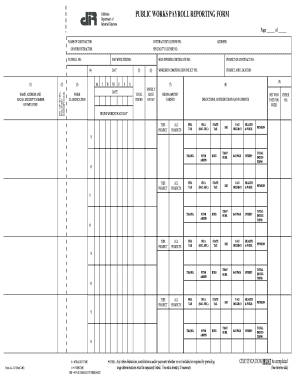

The Public Works Payroll Reporting Form (A-1-131) is essential for contractors and subcontractors in California to accurately report payroll information. This guide provides clear, step-by-step instructions to help you complete the form online efficiently.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the name of the contractor or subcontractor at the designated field. Make sure to include the contractor's license number and payroll number.

- Fill in the week ending date in the appropriate section, ensuring it correctly corresponds to the reporting period.

- Input the name, address, and social security number of each employee in the fields provided. Include the number of withholding exemptions for each employee.

- Detail the work classification for each employee, specifying their specialty license number if applicable.

- For each day of the week, enter the hours worked in the corresponding columns. This includes Monday through Saturday.

- Provide the total hours worked, hourly rate of pay, and the gross amount earned for each employee.

- Fill out the deductions, contributions, and payments section, listing all relevant deductions such as federal and state taxes, social security, and any additional contributions.

- Calculate the net wages paid for the week and complete the check number field.

- Ensure all entries are accurate before proceeding to the certification section. Complete the certification by providing your name, position, and the name of the business, and sign the form.

- After filling out all sections correctly, save changes to the form, then download, print, or share as required.

Start completing your Public Works Payroll Reporting Form online today!

Contractors and subcontractors on most public works projects are required to submit certified payroll records (CPRs) to the Labor Commissioner using DIR's electronic certified payroll reporting system. A few categories of public works projects are exempt from reporting online to DIR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.