Loading

Get Foreign Ownership Of Land Form 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foreign Ownership Of Land Form 2 online

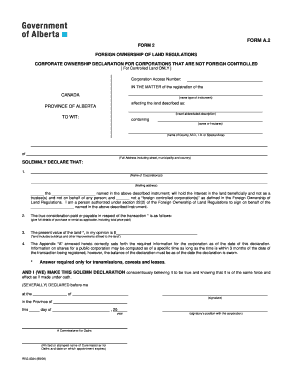

The Foreign Ownership Of Land Form 2 is essential for corporations not classified as foreign-controlled to declare their ownership status regarding land in Alberta, Canada. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to acquire the form and access it in an online editor.

- Begin by entering the corporation's access number in the designated field at the top of the form.

- Fill in the name type of the instrument and the land description, including the province and specific details regarding the acreage and location.

- Declare the name of the corporation and its mailing address in the corresponding sections to confirm ownership of the land.

- Indicate whether the corporation is a foreign-controlled entity by selecting the appropriate option provided in the form.

- Input the full details of the transaction, including the true consideration paid or payable in respect of the purchase or rental, as applicable.

- Record your assessment of the present value of the land, ensuring accuracy in the financial figures provided.

- Attach Appendix 'A' if applicable, ensuring that it accurately reflects the details of shareholders and any relevant information regarding permanent residents, if required.

- After reviewing all entries for accuracy, finalize the declaration by including the signature, the dated statement before a commissioner for oaths, and any identifying information as needed.

- Once completed, save any changes, and use the options available to download, print, or share the form as necessary.

Start filling out your documents online today for a seamless submission process.

What you Should Know. Foreign buyers must pay a 25% tax when buying property in Ontario. BC foreign buyers must pay a 20% tax on top of the property value in certain regions. A foreign buyer purchasing a $1,000,000 house in Vancouver must pay an additional $200,000 in taxes upon closing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.