Loading

Get Withholding Limitations Worksheet - New York - Childsupport Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding Limitations Worksheet - New York - Childsupport Ny online

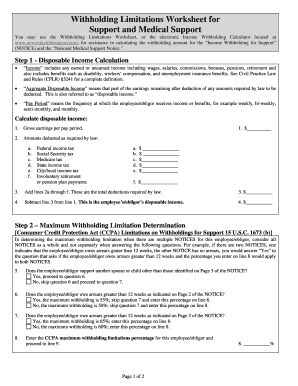

The Withholding Limitations Worksheet for New York provides a structured way to calculate the appropriate withholding amounts for child support and medical support. This guide will walk you through each section of the form, ensuring a clear understanding of how to complete it online.

Follow the steps to fill out the Withholding Limitations Worksheet effectively.

- To begin, press the ‘Get Form’ button to obtain the Withholding Limitations Worksheet. This action will open the form in your document editor, making it easier to complete online.

- In Step 1, calculate the disposable income by filling in the gross earnings per pay period in the designated field. Include all sources of income and benefits.

- Next, identify and input the amounts deducted as required by law. List the individual deductions such as federal income tax, social security tax, and state income tax. Sum these deductions.

- Subtract the total deductions from the gross earnings to determine the disposable income amount.

- Move to Step 2 and assess the maximum withholding limitations. Answer the questions regarding support obligations accurately.

- Record the CCPA maximum withholding limitations percentage that applies based on your responses in Step 2.

- In Step 3, input the disposable income amount from the previous calculation and the CCPA percentage you noted.

- Multiply the disposable income by the withholding limitation percentage to find the maximum amount that can be withheld for all notices.

- Detail the total amounts to be withheld for each notification you have received, ensuring accuracy in the submission.

- Conclude by reviewing the total amounts and determining if further calculations, such as health insurance premium withholdings, are necessary.

- Finally, save your changes, and consider downloading, printing, or sharing the completed form as necessary.

Start filling out your Withholding Limitations Worksheet online today to ensure timely and accurate child support calculations.

Note: Where the total income of both parents exceeds the combined parental income amount of $163,000 the law permits, but does not require, the use of the child support percentages in calculating the child support obligation on the income above $163,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.