Loading

Get Summary Of Account-standard And Simplified Accounts Same As Gc-400sum Gc405sum California Judicial

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Summary Of Account-Standard And Simplified Accounts Same As GC-400SUM Gc405sum California Judicial online

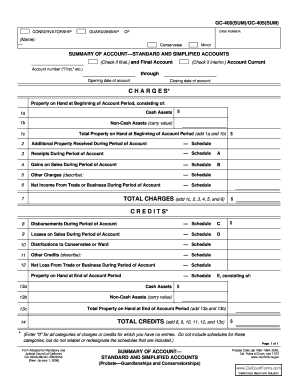

Filling out the Summary Of Account form is a critical step in maintaining proper records for conservatorship and guardianship cases in California. This guide will walk you through the process of completing the form online, ensuring accuracy and compliance with legal requirements.

Follow the steps to successfully complete your Summary Of Account online.

- Press the ‘Get Form’ button to obtain the document and open it in an editable format.

- Begin by entering the case number at the top of the form. This is crucial for identifying your financial account related to the conservatorship or guardianship.

- Indicate whether this is a final account by checking the appropriate box. Additionally, if applicable, you can also check if this is an interim account.

- Fill in the name of the conservatee or minor and enter the opening and closing dates of the account period.

- In the 'Charges' section, list the property on hand at the beginning of the account period. Include both cash assets and non-cash assets (carry value), and calculate the total.

- Document any additional property received during the account period on the appropriate schedule.

- In the next section, record receipts during the account period and any gains on sales, ensuring each entry corresponds with its respective schedule.

- List any other charges that apply, providing descriptions where necessary and using the specified schedules.

- Complete the 'Total Charges' row by summing all the previous charge entries.

- Move on to the 'Credits' section, detailing disbursements during the period and losses on sales, as well as distributions to the conservatee or ward.

- Similar to charges, list any other credits received over the period and net losses from any business activities, referring to the appropriate schedules.

- Calculate the total credits by adding all entries in the 'Credits' section.

- Finally, in the 'Property on Hand at End of Account Period' section, input the final amounts for cash and non-cash assets, and calculate the total.

- Review all entries for accuracy and completeness, ensuring to enter '0' for any categories without entries. Save your changes, and proceed to download, print, or share the completed form.

Start completing your Summary Of Account online today to ensure all entries are accurately recorded.

Estate Executors Must Provide Beneficiaries With Proper Accounting. Under California law, executors of a will must file an accounting of all of the transactions they have conducted while administering the estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.