Loading

Get Form 8d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8d online

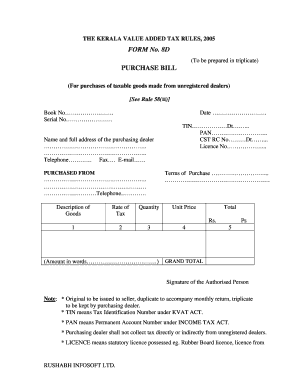

Filling out Form 8d is essential for documenting purchases of taxable goods from unregistered dealers. This guide provides clear, step-by-step instructions to help users navigate the form accurately and efficiently online.

Follow the steps to fill out Form 8d correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the book number and serial number at the top of the form. This helps with tracking and organization of your records.

- Enter the date of the purchase. Ensure the date is accurate to avoid any compliance issues.

- Provide the name and complete address of the purchasing dealer. Include telephone, fax, and email information for contact purposes.

- In the 'purchased from' section, input the TIN, PAN, CST RC number, and license number if applicable. Make sure these numbers are current and correctly reflect the seller’s information.

- Describe the goods purchased thoroughly. Include the rate of tax, quantity, and unit price for each item being documented.

- Calculate the total for each line item and provide the grand total at the end of the form. Write out the amount in words to ensure clarity.

- Have an authorized person sign the form before submission. This signifies that all information provided is true and correct.

- Finally, save your changes, download, print, or share the completed form as required for your records and submissions.

Begin your process today by completing your form online and ensuring compliance with tax regulations.

How to Use the 8D Method to Find the Root Cause of... D0: Plan. ... D1: Form Your Team. ... D2: Define the Problem. ... D3: Contain the Problem. ... D4: Identify the Root Cause. ... D5: Analyze and Select Corrective Actions. ... D6: Implement and Validate Corrective Actions. ... D7: Implement Preventive Actions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.