Loading

Get Form 3372, Michigan Sales And Use Tax Certificate Of Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3372, Michigan Sales And Use Tax Certificate Of Exemption online

Filling out the Form 3372, Michigan Sales And Use Tax Certificate Of Exemption, online is a straightforward process that allows users to claim exemptions from sales and use tax. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the Form 3372 online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

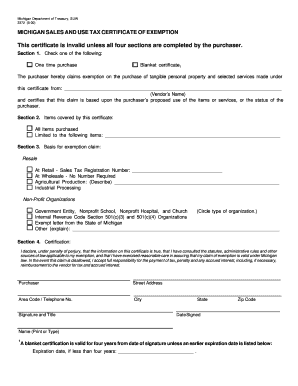

- In Section 1, indicate the type of exemption by checking either the 'One time purchase' or 'Blanket certificate' box. Provide the vendor’s name where indicated.

- In Section 2, specify the items that the certificate covers. You can either select 'All items purchased' or limit it to specific items by detailing them in the provided space.

- For Section 3, select the basis for your exemption claim. Options include 'Resale' which requires a sales tax registration number, 'Agricultural Production', 'Industrial Processing', or select from nonprofit or government categories.

- In Section 4, certification must be completed by the purchaser. Fill in the purchaser's name, address, contact number, city, state, zip code, and date signed. Ensure to sign and indicate your title if applicable.

- Review all completed sections for accuracy. After confirming that all information is correct, you can save changes, download, print, or share the form as needed.

Complete your documents online today to streamline your exemption claims.

To claim exemption for purchases, the buyer must present the seller with a completed Form 3372, Michigan Sales and Use Tax Certificate of Exemption. The seller will retain the certificate in their records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.