Loading

Get Post-retirement Lump-sum Beneficiary ... - Calpers On-line - Calpers Ca

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Post-Retirement Lump-Sum Beneficiary designation form online

Completing the Post-Retirement Lump-Sum Beneficiary designation form is essential for ensuring your designated beneficiaries receive benefits in the event of your passing. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently.

Follow the steps to complete the form successfully

- Click 'Get Form' button to obtain the form. Open the document in your preferred editing tool.

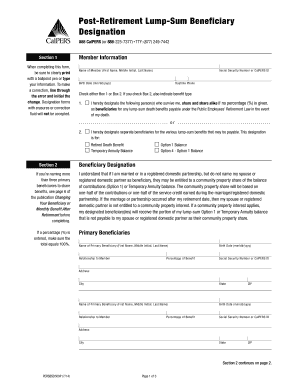

- Begin by clearly printing or typing your information in Section 1. Include your name, Social Security number or CalPERS ID, birth date, and daytime phone number. Ensure accuracy, as corrections must be made by crossing out the error and initialing it.

- Select either Box 1 or Box 2 to indicate your beneficiary designation choice. If opting for Box 1, list the person or persons you wish to designate. If selecting Box 2, indicate the type of benefits for which you are designating separate beneficiaries (Retired Death Benefit or Temporary Annuity Balance).

- In Section 2, for primary beneficiaries, fill out the required fields: name, birth date, relationship to you, Social Security number or CalPERS ID, percentage of benefit, and address for each beneficiary you are designating. If there are more than three beneficiaries, refer to additional guidelines as needed.

- Enter details for any secondary beneficiaries in the provided section, including the same information as required for primary beneficiaries. Ensure that the total percentage for both primary and secondary beneficiaries equals 100%.

- In Section 3, review the member's acknowledgement to ensure you understand the terms and conditions. You must sign and date the form. If you are married or in a registered domestic partnership, ensure your partner also signs the form. If unable to sign, complete the Justification for Absence of Spouse’s or Registered Domestic Partner’s Signature form.

- Once you have completed the form, make a copy for your records and mail the signed form to the address specified at the bottom of the document.

Complete your beneficiary designation form online today to ensure your wishes are accurately documented.

Refund beneficiary means an individual who has been designated to be paid Accumulated Participant Contributions in the event of the death of a Participant or Former Participant, or a residual refund of unexpended Accumulated Participant Contributions in the event of the death of a Retired Participant or Survivor ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.