Loading

Get Dr 313

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 313 online

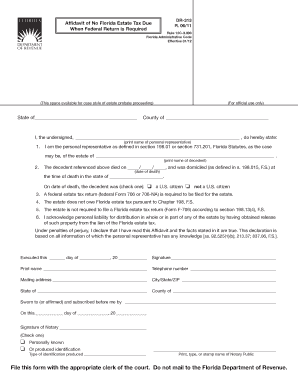

Form DR-313, known as the Affidavit of No Florida Estate Tax Due When Federal Return is Required, is a crucial document for personal representatives managing an estate. This guide offers a clear and supportive approach to completing the form accurately and efficiently online.

Follow the steps to complete the form correctly.

- Click the 'Get Form' button to access the DR-313 form. This action allows you to open the document in your preferred online editor.

- Begin by entering the case style for the estate probate proceeding in the designated space at the top of the form.

- In the first section, clearly print the name of the personal representative who is completing the form.

- For the next section, input the decedent's full name as indicated.

- Fill in the decedent's date of death using the format: day/month/year.

- Specify the decedent's state of domicile at the time of death.

- Select the option indicating the decedent's citizenship status by checking the appropriate box: 'a U.S. citizen' or 'not a U.S. citizen.'

- Acknowledge the need for a federal estate tax return by stating that it is required, and confirm that the estate owes no Florida estate tax.

- Confirm that a Florida estate tax return is not required as per the regulations stated.

- Provide your signature, print your name, telephone number, and mailing address in the designated fields.

- Input your city, state, and ZIP code accurately in the specified area.

- Following your signature, have the form notarized. Ensure the notary's details are filled out correctly, including their signature and the type of identification produced.

- Finally, review the completed form for accuracy before saving your changes. After reviewing, you can download, print, or share the filled DR-313 form as needed.

Take action today and complete your documents online to ensure proper estate management.

The good news is Florida does not have a separate state inheritance tax. Even further, heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes (and Florida does not have a separate income tax).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.