Loading

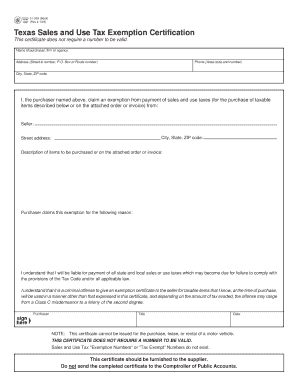

Get 01-339 Sales And Use Tax Resale Certificate / Exemption Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 01-339 Sales And Use Tax Resale Certificate / Exemption Certification online

Filling out the 01-339 Sales And Use Tax Resale Certificate / Exemption Certification online is a straightforward process that enables users to claim exemption from sales and use taxes. This guide will walk you through the essential steps to complete this form accurately and efficiently.

Follow the steps to complete your exemption certification form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name of the purchaser, firm, or agency in the designated field. Be sure to provide the full legal name as it appears in official documents.

- Fill in the address, including the street number, P.O. Box, or route number, ensuring that it is complete for accurate identification.

- Input the phone number, including the area code. This contact information allows the seller to reach you if any questions arise regarding the exemption.

- Provide the city, state, and ZIP code of the purchaser’s address, ensuring alignment with the earlier sections.

- In the seller's information section, enter the seller's name, city, state, and ZIP code. This is essential for ensuring that the correct seller is associated with the exemption.

- Fill out the street address of the seller, which should match the provided name to avoid any discrepancies.

- Describe the items to be purchased in detail or indicate that the relevant details are on the attached order or invoice. Clarity here helps reinforce the purpose of the exemption.

- Specify the reason for claiming the exemption. This is crucial for compliance with tax regulations.

- Sign the form as the purchaser. Include your title and the date of signing to validate the document.

- Review all entered information for accuracy before finalizing the form. Once complete, you can save changes, download the document, print it, or share it with the seller directly.

Complete your documents online to ensure efficiency and accuracy.

A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed Form 01-339, Texas Sales and Use Tax Resale Certificate (PDF), instead of collecting the sales tax due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.