Loading

Get Guarantor

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Guarantor online

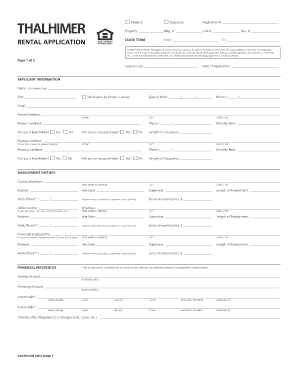

Completing the Guarantor form online is an essential step in securing a rental agreement. This guide will provide you with a clear and supportive step-by-step process to ensure you fill out the form accurately and efficiently.

Follow the steps to complete the Guarantor form online.

- Click ‘Get Form’ button to obtain the guarantor form and open it in your editor.

- Enter the application number and the property details, including building and unit numbers, where applicable.

- Fill in the lease term by indicating the start and end dates of the rental agreement under the designated fields.

- Complete the applicant information section. Include your full name, social security number, date of birth, contact details, and current address. Provide your present landlord's information and answer whether you are a leaseholder or an occupant.

- If you've resided at your current address for less than two years, fill in the previous address and landlord information along with similar details about your rental experience there.

- In the employment history section, provide details of your current employer, including position, contact number, hire date, supervisor’s name, and length of employment. Repeat for any previous employers if currently employed for less than six months.

- List your financial references, including bank information for savings and checking accounts, and details of any automobiles owned.

- Include occupant data by listing all authorized occupants and children’s names and ages.

- Complete the pet information section if applicable, including type, breed, and name of pets you plan to have on the property.

- Provide an emergency contact's name, relationship, and contact details.

- Review the certification statement and sign the application, confirming that all information is accurate. Write the date of signature.

- Finally, save your changes, download the completed form, and consider printing or sharing it as needed.

Complete your Guarantor form online today to begin your rental application process.

Cosigning on an apartment lease can have indirect impacts on your credit history. As a cosigner, you are liable for rent payments should the primary tenant fail to pay. ... Acting as a guarantor won't appear on your credit report itself, but the inquiry from the landlord will appear on the report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.