Loading

Get Kw 5 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kw 5 Form online

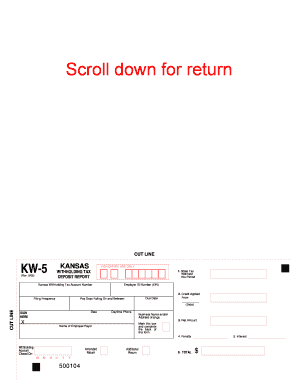

The Kw 5 Form is essential for reporting Kansas income tax withheld from wages and other taxable payments. This guide provides users step-by-step instructions to accurately complete the form online, ensuring compliance with state requirements.

Follow the steps to complete the Kw 5 Form online.

- Click the ‘Get Form’ button to access the Kw 5 Form and open it in the document editor.

- Enter your Kansas withholding tax account number and employer identification number (EIN) in the designated fields. These numbers are crucial for identifying your account.

- In line 1, input the amount of state tax withheld during the specified period. If no tax was withheld, you should enter a zero (0) in this section.

- For line 2, indicate any credit or overpayment from a prior period along with the relevant date. If you have a credit memo, include a copy with your submission.

- Calculate the result for line 3 by subtracting the amount in line 2 from the amount in line 1, and enter this result in line 3.

- For line 4, be aware that a 15% penalty applies if the form is filed or payment is made after the due date.

- Enter applicable interest charges on line 5 if the report is submitted after March 1 of the following year, as the interest rate may vary annually.

- Add the values from lines 3, 4, and 5, and write the total on line 6. This total represents your final amount due.

- Sign and date the deposit report in the signature area, and provide your daytime phone number for any necessary follow-up.

- Ensure remittance is made payable to 'Kansas Withholding Tax' and mail it to the specified address. If there have been changes in your business information, indicate this on the back of the form.

Take action today by completing your Kw 5 Form online to stay compliant with Kansas tax reporting requirements.

State. Zip Code. Page 3. INSTRUCTIONS FOR FORM KW-5, KANSAS WITHHOLDING TAX DEPOSIT REPORT. Use this form to report the Kansas income tax withheld from wages and/or other taxable payments as required by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.