Loading

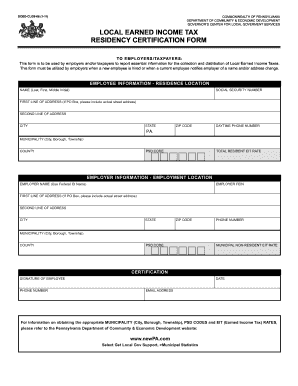

Get Local Earned Income Tax Residency Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM online

This guide provides step-by-step instructions for completing the Local Earned Income Tax Residency Certification Form online. Whether you are an employer or a taxpayer, understanding how to accurately fill out this form is essential for reporting your local earned income tax information.

Follow the steps to complete the form easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the employee information section. Enter the employee's name (last, first, and middle initial), social security number, and their address, ensuring to provide the first line of the address, and include the actual street address if using a P.O. Box. Complete the second line of the address as necessary.

- Continue to fill in the city, state, and zip code fields for the employee's residence location. Include their daytime phone number, the Pennsylvania municipality (city, borough, township), and the county.

- Proceed to the employer information section. Input the employer name as it appears on the federal identification, followed by the employer's Federal Employer Identification Number (FEIN). Fill out the employer's address in the same manner as the employee’s address, ensuring accuracy in the city, state, and zip code fields.

- Complete the fields for the employer's phone number and the municipality where the employer is located, alongside the appropriate county and PSD code for employment.

- Indicate the municipal non-resident earned income tax rate applicable to the employee. This ensures proper tax reporting based on the employee's residency status.

- In the certification section, the employee must sign and provide their phone number, date, and email address. This certification serves as a declaration of the truthfulness of the information provided.

- Once all required fields are completed, save your changes. You may choose to download, print, or share the form as needed to ensure it reaches the relevant parties.

Complete your LOCAL EARNED INCOME TAX RESIDENCY CERTIFICATION FORM online today for accurate tax reporting.

Most Pennsylvania municipalities levy an earned income tax on their residents at the rate of 1%. ... The following is a guide for employers on the proper withholding of municipal earned income taxes ( EIT Taxes ) for employees working out of a location where the work location EIT tax is greater than 1%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.