Loading

Get 41a720sl

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 41a720sl online

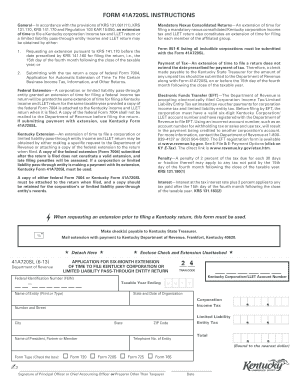

Filling out the 41a720sl form online is essential for securing an extension for filing your Kentucky corporation income tax and limited liability entity tax returns. This guide provides a step-by-step approach to help users navigate the form efficiently and accurately.

Follow the steps to complete the 41a720sl form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your federal identification number (FEIN) into the relevant field. Make sure to verify this number is accurate to avoid processing delays.

- Input the Kentucky corporation/LLET account number. If you do not have one, it is important to acquire it before proceeding.

- Indicate the taxable year ending by selecting the month and entering the year appropriately.

- Type the name of your entity clearly in the designated area. Ensure the name matches the official documents of your corporation or limited liability entity.

- Provide the state and date of organization. This information is crucial for establishing your entity's legal status.

- Complete the address information by filling in the number and street, city, state, and ZIP code for your entity.

- Select the appropriate form type by checking the corresponding box (Form 720, Form 720S, Form 725, or Form 765) based on your filing requirements.

- Have the principal officer, chief accounting officer, or an authorized individual sign in the designated area. This signature certifies the accuracy of the information provided.

- Finally, save your changes and download the completed form. You may need to print it and include a check made payable to the Kentucky State Treasurer if applicable. Ensure that you send it to the Kentucky Department of Revenue to meet filing deadlines.

Complete your documents online to ensure timely processing and compliance.

Extensions - Kentucky allows an automatic extension of six months if no additional tax is due AND a federal extension has been filed. Any extension granted is for time to file and does NOT extend time to pay. The Kentucky extension application can be e-filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.