Loading

Get 72a066 (8-06) Application For Refund Of Kentucky Tax Paid On ... - Revenue Ky

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 72A066 (8-06) APPLICATION FOR REFUND OF KENTUCKY TAX PAID ON GASOLINE online

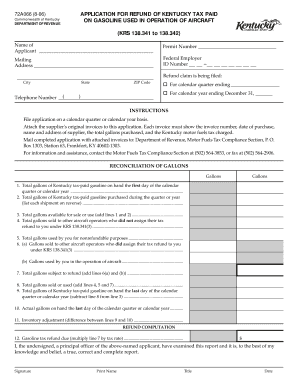

This guide provides users with a comprehensive approach to completing the 72A066 (8-06) Application for Refund of Kentucky Tax Paid on Gasoline Used in Operation of Aircraft. With clear instructions and supportive guidance, users will navigate the refund application process with ease.

Follow the steps to fill out the form successfully.

- Press the ‘Get Form’ button to access the application and open it in the designated editor.

- Enter the name of the applicant in the specified field, ensuring that all provided information matches official records.

- Input the permit number associated with the applicant's operations.

- Fill in the mailing address, including city, state, and ZIP code, ensuring that all details are accurate for timely correspondence.

- Enter the federal employer ID number without any spaces, using the format XX-XXXXXXX.

- Provide the telephone number in the designated field, formatted as (XXX) XXX-XXXX.

- Indicate the refund claim period by checking the appropriate box for either a calendar quarter or calendar year.

- Attach the supplier's original invoices to the application, ensuring that each invoice includes the required details such as invoice number, date of purchase, supplier name and address, total gallons purchased, and the Kentucky motor fuels tax charged.

- Complete the reconciliation of gallons section by providing totals for each requested line item related to gasoline on hand, purchased, sold, and used.

- Calculate the gasoline tax refund due by multiplying the total gallons subject to refund by the applicable tax rate.

- Sign and print your name in the space provided, stating your title and date to confirm the accuracy of the information.

- Finally, save changes, download, or print the completed form to keep a record for your files and submit it as instructed.

Start completing your application for refund online today!

Related links form

Penalties That May Be Imposed. Late Filing - Two (2) percent of the total tax due for each 30 days or fraction thereof that a tax return or report is late. The maximum penalty is 20 percent of the total tax due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.