Loading

Get Ar4ec

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar4ec online

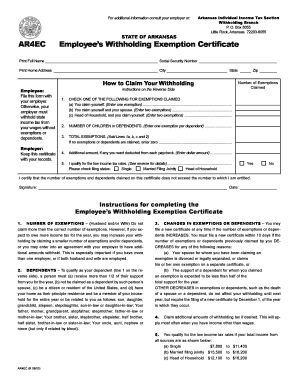

Filling out the Ar4ec, the Employee’s Withholding Exemption Certificate, is essential for managing your state income tax withholdings effectively. This guide provides clear, step-by-step instructions to help you complete the form accurately and online.

Follow the steps to fill out the Ar4ec form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing. This is your first step in accessing the necessary fields for completion.

- Print your full name in the designated field and provide your Social Security number. It’s crucial to ensure this information is accurate, as it links your tax records.

- Enter your home address in the specified area, followed by your city, state, and zip code. Ensure all address details are current to avoid any correspondence issues.

- In the section labeled 'Number of Exemptions Claimed,' carefully check one of the options reflecting your situation: (a) if you claim yourself, (b) if claiming yourself and your partner, or (c) if you are head of household.

- Specify the number of children or dependents you are claiming. Enter one exemption per child or dependent.

- Calculate your total exemptions by adding the numbers from the previous sections. If no exemptions or dependents are claimed, enter zero.

- If you wish to have an additional amount deducted from each paycheck, note the dollar amount in the provided field.

- Indicate whether you qualify for low income tax rates by checking 'Yes' or 'No' as applicable. Review the thresholds for your specific filing status.

- Sign and date the form at the bottom, certifying that the information provided is accurate. Your signature is necessary for validation.

- Once completed, save your changes, and download or print the form. Submit the finished form to your employer as instructed.

Complete your Ar4ec form online to ensure your tax withholdings are managed correctly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The taxpayer is required to file an Arkansas Individual Income Tax Return and submit all appropriate W- 2's and schedules to support the income and deductions. The form AR-TX is also submitted with the tax return which reports the exempt amount of wages earned from a particular employer.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.