Loading

Get Acd31102

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Acd31102 online

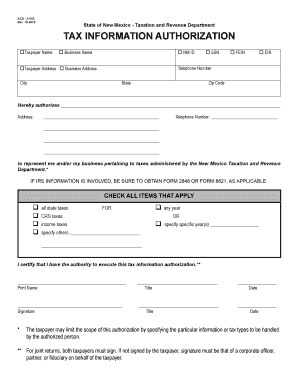

The Acd31102 form is an essential document for authorizing a representative to handle tax matters on your behalf with the New Mexico Taxation and Revenue Department. This guide will help you navigate the online form with clear, step-by-step instructions to ensure correctness and completeness.

Follow the steps to fill out the Acd31102 form online.

- Press the ‘Get Form’ button to obtain the Acd31102 form and open it in your preferred online editor.

- In the first section, enter your name under 'Taxpayer Name'. If applicable, fill in your business name in the corresponding field.

- Provide your New Mexico ID number, Federal Employer Identification Number (FEIN), or Employer Identification Number (EIN) as required.

- Fill in your telephone number and both your taxpayer and business address, including city, state, and ZIP code.

- In the section labeled to authorize representation, clearly write the name of the person or entity you are authorizing, along with their address and telephone number.

- Select the items that apply to your authorization by marking the relevant checkboxes, such as all state taxes or specifying certain tax years.

- Complete the certification by entering your printed name, title, and date. Then provide your signature where indicated.

- Once you have filled out all sections, review the form for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your tax information authorization online today.

Tax Information Authorization You can use Form 8821 to allow the IRS to discuss your tax matters with designated third parties and, where necessary, to disclose your confidential tax return information to those designated third parties on matters other than just the processing of your current tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.